The doors of the Metaverse are within reach to anyone interested, through the several platforms which have contributed to its emergence. In 2026, it is expected that about 25% of the global population will spend at least 1 hour a … Read More

Derivatives Exchange Development

Derivatives Exchange Development

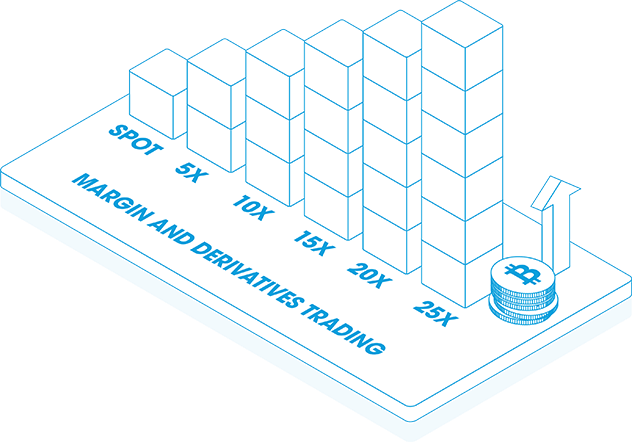

High Leverage

Allow your users to amplify their building or selling power by using leverage up to mutiple times.

Muti-layer Security

The market-leading security features like SSl implementation an two-factor authentication ensure legitimate user access.

Advanced Order Types

Our exchange is integrated with other trading order types such as market order, copy trading, and more.

Powerful Trading Engine

The powerful trading engine offers unprecedented speed and reliability, fortifying the performance of our exchange.

Muti-currency Wallet

The muti-currency wallet integrated into our exchange ensures secure and accelerated transactions for a spectrum of cryptocurrencies.

Robust Admin panel

A robust Admin panel facilitates monitoring of user activities and transactions happening on the platform.

Exchange

Crypto Derivatives Exchange Development Services

Unlock the future of crypto trading with advanced crypto derivatives trading services

Crypto Derivatives Exchange

A crypto derivative is tradable security or an automated financial contract between parties based on the price of the asset at a particular time in the future. Being a reputed smart contract development company, Chainversum Solutions offers top-notch derivatives exchange development services that promise newer investment boulevards for the traders.

What is the Working Process of Crypto Derivatives?

In crypto derivatives trading, the underlying asset can be any cryptocurrency token. The two parties that engage in a financial contract speculate the price of the cryptocurrency on a specific day in the future. At the initial phase of the contract, the parties agree upon the selling/buying price of the cryptocurrency on the decided date, no matter what the market price could be. Therefore, investors can capitalize on the change in the price of the underlying asset by buying the currency at a lower price and selling it at a higher price.

Crypto derivatives can be traded on both centralized exchange and decentralized exchange platforms. Exchange owners can leverage the potential of a cryptocurrency derivatives exchange to reach more investors. A Crypto derivative trading platform is more flexible than Spot Margin trading and opens access to otherwise unavailable markets.

The Ascending Potential of a Crypto Derivatives Trading Exchange Platform

More than just minting profits, cryptocurrency derivatives trading is a golden opportunity for investors to eliminate the risks of a highly volatile digital asset. This has improved the acceptance of crypto trading among mainstream investors while promising a brighter future for a trading ecosystem. With derivatives exchange development, financial institutions can leverage the following benefits-

Derivative Strategies that Our Exchange Supports

Chainversum Solutions brings into play vast industrial experience in curating absolute crypto exchange products and platforms. As a reputed derivatives exchange development company, we empower the investors to reap more benefits and face less complexity. With a razor sharp focus on risk management at the back-end and an intuitive customer experience at the front, our ready to deploy derivatives trading platforms ensure accelerated time-to-market.

Derivatives Trading Features Supported by our Exchange Platform

1

Auto Deleveraging (ADL)

2

Stop Loss/Take Profit

3

Partial Close Orders

4

Insurance Funds

Supported Forms of Crypto Derivative Trading

Our Derivatives Exchange Development Services enables the following 4 key types -

Futures Trading

The buyer/seller decides upon a fixed price of the crypto asset at a particular date in the future. The contracts are standardized and have an expiry date.

Forwards Trading

Similar to Futures but the contract is customizable and flexible as per the needs of both parties. Both parties can alter the conditions of the contract including the underlying asset.

Options Trading

The buyer reserves the right to or not to make the purchase as per the agreed date. In addition to the date, the buyer can ask for a purchase at a particular time.

Perpetual Trading

Both parties exchange one type of cash flow into another on a particular date in the future. These Swaps are mostly governed by interest rates, currencies and commodities.

Blogs

Metaverse Education Platform Transforming the Future of the Education Industry

Development of Cryptocurrency- How Is It Impacting Small Businesses

The use of cryptocurrencies is becoming increasingly popular in the global arena. Therefore, it would be necessary to understand how Cryptocurrency development impacts modern finance. It is a well-known fact that businesses are largely adopting crypto culture because of the speedy and … Read More

Extraordinary Features Offered by Bitcoin Exchange Script

The cost and time taken to develop advanced Bitcoin Exchange software from scratch vary depending on the feature requirements and development budget. Apart from the security parameters, another aspect that determines the success of a crypto exchange is its time-to-market. However, if … Read More